14+ paycheck calculator north dakota

North Dakota tax year starts from July 01 the year before to June 30 the current year. There also arent any local income taxes.

Free 50 Payroll Templates And Samples In Pdf Ms Word Excel Numbers Google Docs Google Sheets

Just enter the wages tax withholdings and other information required.

. As mentioned above South Dakota does not have a state income tax. Calculating paychecks and need some help. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

North Dakota has one or more Locality Pay Adjustment areas with special locality pay adjustment rates. Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota. This tool has been available since 2006 and is visited by over 12000.

For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. No personal information is collected. Use ADPs North Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. North Dakota Hourly Payroll Calculator - ND Paycheck Calculator. Back to Payroll Calculator Menu 2013 North Dakota Paycheck Calculator - North Dakota Payroll Calculators - Use as often as you need its free.

Our paycheck calculator is a free on-line service and is available to everyone. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4. The 2022 wage base is 147000.

Need help calculating paychecks. Make Your Payroll Effortless and Focus on What really Matters. North Dakota Hourly Paycheck Calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. This page lists the locality-adjusted yearly GS pay scales for each area with starting pay. Ad Compare Prices Find the Best Rates for Payroll Services.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. This makes South Dakota a generally tax-friendly. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in North Dakota.

North Dakota Hourly Paycheck and Payroll Calculator. Payroll pay salary pay check. The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income.

The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You.

Federal Register Medicare And Medicaid Programs Cy 2016 Home Health Prospective Payment System Rate Update Home Health Value Based Purchasing Model And Home Health Quality Reporting Requirements

North Dakota Paycheck Calculator Smartasset

Birches Townhomes 208 34th St E Williston Nd Rentcafe

North Dakota Income Tax Calculator Smartasset

North Dakota Paycheck Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

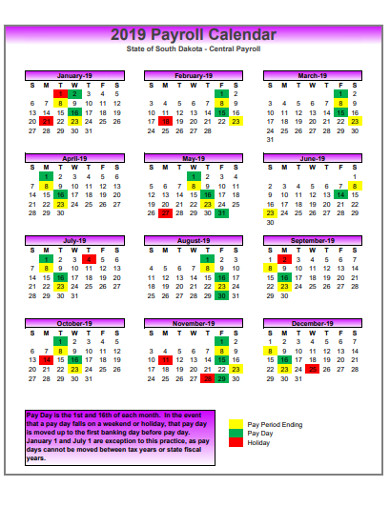

Payroll Calendar 19 Examples Format Pdf Examples

Paycheck Calculator Take Home Pay Calculator

Dakota Digital Mlx Led Replacement Upgrade Gauges 14 2021 Harley Touring Bagger Ebay

Southpoint Apartments 3450 Ruemmele Road Grand Forks Nd Rentcafe

Earning Calculating Your Pay The Disney College Program Life

Parents Can Use A 529 Plan To Pay For K 12 But Most Won T

Southpoint Apartments 3450 Ruemmele Road Grand Forks Nd Rentcafe

Leachman 2020 Private Treaty Grass Time Sale By Leachman Issuu

Regional Optimist January 19 By Battlefords News Optimist Issuu

North Dakota Paycheck Calculator Adp

Free 50 Payroll Templates And Samples In Pdf Ms Word Excel Numbers Google Docs Google Sheets